**Note: this blog post does not go over the super powerful CMHC MLI Select but the information provides fundamental insights on how construction financing typically works. The CMHC MLI Select product uses similar topics but the cash requirements and loan to values are completely different**

High-Level Summary of Construction Financing

- Construction projects very typically will need 40-50% of the total cost (land purchase + construction cost) in cash

- They don’t give out the mortgage funds up front. They give it out in chunks (called draws) through out the project at key milestones

- There are many different lender options and mortgage options so you can fine tune the mortgage to fit your needs

How does construction financing work?

First… Here’s what does not happen

There are 3 BIG things that do not happen, that surprises almost every client I talk to about construction financing.

- The total loan to value (and loan to cost) is a lot lower than people expect. Most lenders are between 65%-75% loan to cost.

- The loan to value at the start is based on the land value NOT the current property value. This becomes an issue when the borrower bought the land with a house on it, thinking the land draw will be based on the land plus property value. Unfortunately, that’s not the case as you will be tearing down the house in a full construction project. If you are keeping the structure intact and only adding an addition, see my (future) post about purchase plus improvements mortgages which are related to those types of projects.

- You don’t get the capital from the lender up front. Construction mortgages use draw schedules (see below) and only give out portions of funds after you’ve completed a specific amount of the project.

The 3 Phases of Construction Financing

- Land Financing

- The Draw Term

- Completion Mortgage

Land Financing

Land financing is the initial draw for most builders.

If you already own the land outright, you may or may not need this.

The land draw typically ranges from 50-65% but can potentially go higher with some lender products.

The lower range loan to value is typical when the land is not serviced. Since servicing and rezoning can take quite a bit of time, this is one of the big risks when taking on a construction project as the land (especially raw un-serviced land) rates can be quite steep.

Draw Schedule / Draw Term

As you navigate through the draw term of your mortgage, the funds will be advanced in stages, based on the progress of your project. Generally, you can expect about 4 or 5 draws which are decided at the outset and NOT negotiable once set in stone. The amounts dispensed at each stage adhere to a formula calculated on the percentage of project completion.

How the Draw Works:

When you are nearing the next milestone corresponding to the draw schedule (eg. the lock up stage), you will request an inspection. The inspector works with the lender and will verify that the work is complete. They often visit the site as well.

As your project progresses, the draw amount is computed based on the percentage completed. This amount is then sent to your lawyer, who subsequently pays your builder on your behalf (after withholding the necessary builder’s lien holdback as required by law).

The formula used to calculate the maximum draw advance is as follows:

Max Draw Amount ($) = (% Complete) * (Total Project Cost) – (Down Payment) – (Total Draws Already Made)

You’ll notice that the formula is not actually related to the actual cost to get to the next stage. It’s instead driven by the formula!

This is one of the biggest misconceptions around construction financing and can cause liquidity challenges so you need to pay attention to the net cash required between draws!

Completion Mortgage

The completion mortgage is related to the builder / developer keeping the property after construction.

If you are working directly with an A lender or B lender, they often will loop the completion mortgage into the initial review. This will smooth out the processing of the mortgage and financing game plan. The completion mortgage in this case is a standard mortgage. The qualification, rates, loan to value and costs are the same as normal residential lending.

If you are doing the construction financing with a private lender and you intend to keep the property, you likely will want to “exit” into a better long term mortgage product. This typically would be a refinance at the end of the project and you would look at standard A or B lender financing. This will require qualifying for the mortgage so it’s best practice to get pre-qualified for this before taking on the project at all.

Of course, if you intend to sell the property, this phase is not as relevant. I do suggest reviewing it just in case for a potential exit plan.

One risk when building to sell is a soft market. This may cause a delay in the sale, or at worst, no buying activity for that product at all!

Case Study of a Construction/Draw Mortgage

Meet George and Rebecca:

George and Rebecca want to buy some land and build a house on it. The land they’ve found has a value of $500,000 and they will need to get mortgage financing on it.

Currently, the land is already serviced and re-zoned.

They get some estimates from builders and determine that their project will cost $500,000 to complete. The major milestones align with a 4 draw construction mortgage. The lender in this case is really loose with their Loan to Cost ratio and will go all the way up to 75% LTC.

The construction financing will thus look like the following:

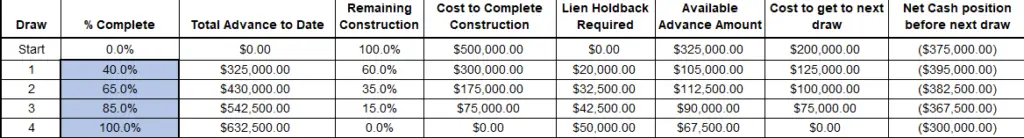

Sample Draw Schedule:

Here is a description of each column:

- % Complete – the estimate of the percent value for each milestone in the draw schedule

- Total Advance to Date – this is the total amount of funds that the lender has given to George and Rebecca at the start of that phase. It’s effectively the mortgage loan size disbursed

- Remaining Construction – the percent value of the remining construction project

- Cost to Complete Construction – the estimated remaining cost given how much construction project is still waiting to be completed

- Lien Holdback Required – Lenders generally require a lien holdback (I will create a separate post about this shortly)

- Available Advance Amount – this is how much funds will be made available at the end of that phase. It is the amount of capital the lender will disburse from the total draw mortgage

- Cost to get to next draw – The total amount of cash required for the construction during that phase

- Net Cash Position before next draw – this is how much cash is required (construction cost plus potential down payment) before the next draw is disbursed

How much cash do you need for building a new house

One the biggest challenges with construction financing is the amount of capital and liquidity a builder or developer needs.

In standard residential financing, you can buy a property with an 80% mortgage and only need 20% down payment. It’s also straight forward financing with no draws.

It’s completely different in the construction financing space.

Because of the non-intuitive construction draws, the land draw, and the lower loan-to-value/loan-to-cost with construction financing, you will actually need quite a bit of capital to get the deal done.

One of the decision factors in which lender to use is how many draw schedules and what LTV/LTC they allow.

From George and Rebecca’s example above, you will notice on the far right hand side there is the column “Net Cash Position Before Next Draw”.

This is the cash required at each phase.

To understand how much cash you will likely need, you find the largest negative net cash position in that column. In their case it’s the second row with $395,000.

This means that for George and Rebecca (example from the case study) to take on this project they will need at least $395,000. (Note: this is not inclusive of fees, interest, delays, or overages).

Payment Terms (Interest Only, Cash Reserves, Interest Reserves, Balloon Payments)

Most construction loans are interest only loans, meaning there is no principal pay down – which makes sense because you need the funds to build!

There’s typically 3 ways the interest is paid:

- Monthly interest payments

- Taken from the draw schedule

- Balloon payment (i.e. the interest payments are added to the mortgage balance and are paid out at the end of the term)

Many lenders may also require additional cash reserves to cover unforeseen costs, or even cash reserves to pay for the interest associated with the mortgage.

How do A Lenders and Private Lenders Differ on Construction and Land Mortgages?

When looking at construction financing, there can be several different options to finance. Each with their own pros and cons.

MAJOR thing to keep in mind with these notes, credit markets change drastically all the time. Some features may exist during times of loose monetary and credit cycles where as many features and lenders may pause lending construction loans when credit tightens.

Here are the main pros and cons for the different lender types that do construction financing:

| Pros | Cons | |

| A Lender | Best rates, fees and terms (aka much cheaper than private lending). Seamless transition into the completion mortgage. Typically fund based on the borrower as opposed to the property so can be easier in smaller areas. | Restrictive on where the capital comes from. You need to qualify with standard mortgage guidelines. Can be difficult to income qualify. Typically will have lower loan-to-value / loan-to-cost which means you may need to bring extra cash into the build. May require a licensed or registered builder – so may not be a great option for self builds. Limitations on number of properties, number of mortgages, use of property. |

| B Lenders and Private Lenders | More flexible in their loan-to-value/loan-to-cost calculation and draw schedules. More flexible with their payment options – some can even do balloon payments. Many don’t require income qualification or debt servicing qualification. Don’t have a limit on number of doors or projects on the go. | More expensive. Rates and Fees involved can be steep. If you intend to hold the property after you will have to refinance into the completion mortgage. |

Construction Financing and Draw Schedule Worksheet

Now, this can all seem like a lot. And it is.

That’s why I’ve built a construction financing and draw schedule worksheet!

Before I put the link, please remember that every lender is different AND you still have to qualify. This worksheet is intended to give you a feel for how construction financing works and for the liquidity / cash requirements.

Construction Financing and Land Development Financing Summary

- Construction projects very typically will need 40-50% of the total cost (land purchase + construction cost) in cash

- They don’t give out the mortgage funds up front. They give it out in chunks (called draws) through out the project at key milestones

- There are many different lender options and mortgage options so you can fine tune the mortgage to fit your needs

If You Need Help Navigating the Money Part of Your Construction Project, I’m Here to Help!

You need an experienced mortgage broker or banker working on your construction deal so you can focus on efficiently building the property.

Here’s how I can help:

✅ Customized Solutions: Get financing options that fit your unique construction needs.

✅ Expert Guidance: Feel confident with step-by-step support at every stage.

✅ Team Player: Whether you have your team already or need another spoke in your wheel, I’m ready to work with your team.

Click below to schedule a strategy session today to work out your unique financing plan.